KP Budget 2025-26

The Khyber Pakhtunkhwa (KP) government has revealed its budget for the fiscal year KP Budget 2025-26, with a total outlay of Rs. 2,119 billion. This year’s budget is surplus, meaning the province’s income exceeds its expenditures. The KP Finance Minister, Aftab Alam, presented the budget in the local assembly, proclaiming a 10% increase in salaries and a 7% increase in pensions for government employees.

One of the key highlights is that the government has not compulsory any new taxes, focusing instead on increasing the tax base. The budget ranks education, health, energy, and infrastructure, with important distributions to recover community facilities.

More Read: 8171 Web Portal New Update June 2025

Quick Overview of KP Economical 2025-26

Here’s a quick summary of the major announcements:

| Category | Details |

| Total Budget | Rs. 2,119 billion (Surplus) |

| Salary Increase | 10% for government employees |

| Pension Increase | 7% for pensioners |

| Education Budget | Increased by 11%, Rs. 5.9 billion for school upgrades |

| Health Budget | Increased by 19%, Rs. 11.9 billion for medicines |

| Energy & Power | Rs. 29.6 billion for hydropower & solar projects |

| Transport & Mass Transit | Rs. 10 billion for BRT operations & new buses |

| Irrigation | Rs. 45.5 billion for water management projects |

| New Taxes? | No new taxes, but tax base expanded |

KP Budget 2025-26 Salary Increase Details

The 10% salary increase applies to all rural government teams, while seniors will see a 7% hike. This tuning is meant to help bodies cope with rise and rising living costs.

KP Economical 2025-26 Salary Increase Calculator

If you want to calculate your new salary after the 10% increase, here’s a modest formula:

New Salary = Current Salary + (Current Salary × 0.10)

Example:

- If your current salary is Rs. 50,000, your new salary will be:

50,000 + (50,000 × 0.10) = Rs. 55,000

Similarly, for pensions:

New Pension = Current Pension + (Current Pension × 0.07)

More Read:8171 Web Portal Registration June 2025

Key Allocations in KP Budget 2025-26

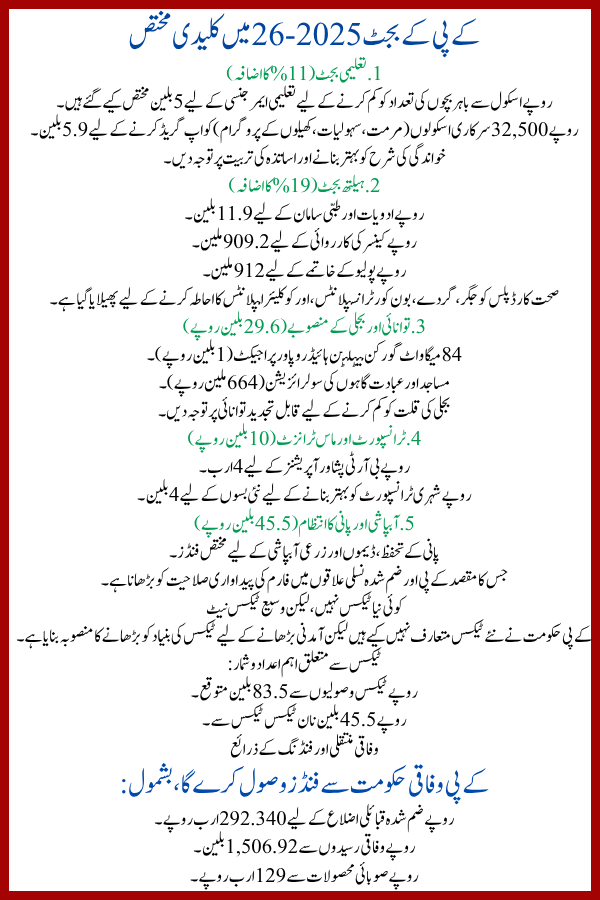

1. Education Budget (Increased by 11%)

- Rs. 5 billion allocated for an education emergency to reduce out-of-school children.

- Rs. 5.9 billion for upgrading 32,500 public schools (repairs, facilities, sports programs).

- Focus on refining literateness rates and teacher training.

2. Health Budget (Increased by 19%)

- Rs. 11.9 billion for medicines and medical supplies.

- Rs. 909.2 million for cancer action.

- Rs. 912 million for polio abolition.

- Sehat Card Plus expanded to cover liver, kidney, bone core transplants, and cochlear implants.

3. Energy & Power Projects (Rs. 29.6 Billion)

- 84MW Gorkin-Matiltan Hydropower Project (Rs. 1 billion).

- Solarization of mosques & worship places (Rs. 664 million).

- Focus on renewable energy to reduce power shortages.

4. Transport & Mass Transit (Rs. 10 Billion)

- Rs. 4 billion for BRT Peshawar operations.

- Rs. 4 billion for new buses to improve urban transport.

5. Irrigation & Water Management (Rs. 45.5 Billion)

- Funds allocated for water conservation, dams, and agricultural irrigation.

- Aimed at boosting farm productivity in KP and merged ethnic regions.

No New Taxes, But Wider Tax Net

The KP regime has not introduced new taxes but plans to expand the tax base to increase income. Key tax-related figures:

- Rs. 83.5 billion expected from tax takes.

- Rs. 45.5 billion from non-tax takes.

Federal Transfers & Funding Sources

KP will receive funds from the federal government, including:

- Rs. 292.340 billion for merged tribal districts.

- Rs. 1,506.92 billion from federal receipts.

- Rs. 129 billion from provincial revenue.

More Read:BISP Stops 8171 Payments for Loan Takers –

Final Thoughts

The KP Budget 2025-26 emphases on public welfare, infrastructure, and economic stability. With salary hikes, better healthcare, and education reforms, the administration aims to improve alive values. The surplus budget indicates strong financial planning, ensuring funds are available for key arrangements.

FAQs About KP Budget 2025-26

How much is the salary increase in KP Economical 2025-26?

10% for employees, 7% for pensioners.

Is there any new tax in KP Economical 2025-26?

No new taxes, but the tax net is being long-drawn-out.

What is the total budget of KP for 2025-26?

Rs. 2,119 billion (surplus).

How much is allocated for health and education?

- Health: 19% increase (Rs. 11.9 billion for medicines).

- Education: 11% increase (Rs. 5.9 billion for colleges).