Easy Business Card Scheme 2025

The Punjab government has launched the Easy Business Card Scheme to provision new entrepreneurs and small commercial owners. Under the management of Chief Minister Maryam Nawaz Sharif, this creativity provides interest-free loans to help individuals start or swell their productions.

If you’re looking for financial assistance to unveiling your private, this outline is a unique opening. Below is a quick overview of the plug-in:

More Read:Phase II of CM Punjab Free Livestock Program 2025

| Program Name | Easy Business Card Scheme |

| Start Date | 2023 (Ongoing in 2024) |

| End Date | Not Specified (Open for Applications) |

| Loan Amount | Up to Rs. 1,000,000 (Varies by business type) |

| Application Method | Online & Offline (Bank branches & official portal) |

| Eligibility | Pakistani citizens, SMEs, startups, women entrepreneurs |

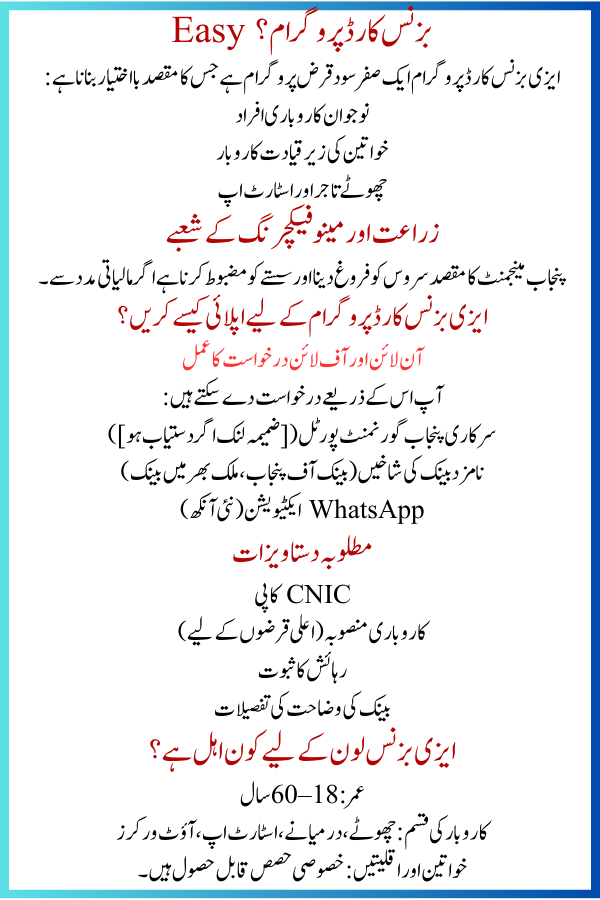

What is the Easy Business Card program?

The Easy Business Card program is a zero-interest loan program intended to empower:

- Young entrepreneurs

- Women-led businesses

- Small traders & startups

- Agriculture & manufacturing sectors

The Punjab management aims to boost service and strengthen the cheap by if monetary support.

More Read:8171 Ehsaas Web Portal Registration 2025

How Much Loan Can You Get?

The loan totals vary based on corporate type:

- Small businesses: Rs. 100,000 – Rs. 500,000

- Women entrepreneurs: Up to Rs. 1,000,000

- Agriculture & manufacturing: Advanced bounds for export-based trades

Current Loan Status – Punjab Business program

Loans Disbursed So Far (2025 Latest Data)

Here’s the latest failure of loans if:

- Total Loans Issued: Rs. 43 billion

- Beneficiaries: 104,000+ individuals

- Women Businesspersons: 6,753 women conservative Rs. 3.42 billion

- Youth & Startups: 3,010 people obvious Rs. 18 billion

Sector-Wise Loan Distribution

| Sector | Loan Amount (Rs.) | Beneficiaries |

| Transportation | 3.91 billion | 13,012 people |

| Trade & Services | 26.13 billion | 61,996 people |

| Agriculture | 3.69 billion | 10,699 people |

| Manufacturing | Special packages coming soon |

How to Apply for the Easy Business Card program?

Online & Offline Application Process

You can apply through:

- Official Punjab Govt Portal ([Supplement Link if available])

- Designated Bank Branches (Bank of Punjab, Countrywide Bank)

- WhatsApp Activation (New Eye)

Required Documents

- CNIC copy

- Business plan (for superior loans)

- Proof of residence

- Bank explanation particulars

More Read:BISP Registration for Transgenders 2025

New WhatsApp Activation Feature for Business Car

A revolutionary update allows candidates to trigger their Easy Business Card via WhatsApp, manufacture the course sooner and more translucent.

How to Activate via WhatsApp?

- Send your request details to the authorized WhatsApp number.

- Receive a verification code.

- Confirm start & fee funds.

Special Loan Plan for Export & Manufacturing

Punjab CM Maryam Nawaz Sharif has declared a special package for:

- Export-based businesses

- Large-scale manufacturing

- Tech startups

This will help Pakistani trades contribute generally.

Who is Eligible for the Easy Business Loan?

- Age: 18 – 60 years

- Business Type: Small, medium, startups, outworkers

- Women & Minorities: Special shares obtainable

More Read:Punjab Approves 27,000 New Education Department Posts

Benefits of the Punjab Easy Business Card Scheme

Interest-free loans

Easy repayment plans

Support for women & youth

Digital activation via WhatsApp

Final Verdict – Should You Apply?

If you need coffers to start or grow your business, this is the finest time to apply. The Easy Business Card Scheme is a game-changer for Pakistani directors.

How to Get More Details?

- Visit the Punjab Govt’s official website

- Contact Bank of Punjab or National Bank

- Follow informs on CM Maryam Nawaz Sharif’s statements

Frequently Asked Questions (FAQs)

Is the loan really interest-free?

Yes the Punjab government offers 0% interest under this arrangement.

Can freelancers apply?

Yes, freelancers and digital businesspersons are qualified.

How long does approval take?

Approval usually takes 2-4 weeks after text tender.