Asan Karobar Finance Scheme Phase 2

If you’re a small or medium commercial owner in Punjab observing for monetary provision, the Asan Karobar Finance Scheme Phase 2 is a excellent occasion for you. Hurled by Chief Minister Maryam Nawaz Sharif, this inventiveness delivers interest-free loans to help businesspersons grow their trades, boost the cheap, and make jobs.

In this article, we’ll cover all you need to know around the scheme—aptness, loan details, application process, payment terms, and FAQs. By the end, you’ll have all the gen required to apply positively.

More Read:Facing AZAG Application Rejection in 2025?

Quick Overview of Asan Karobar Finance Scheme Phase 2

| Detail | Information |

| Program Name | CM Punjab Asan Karobar Finance Scheme Phase 2 |

| Start Date | 2025 (Announced by CM Maryam Nawaz) |

| End Date | Ongoing (Until funds are exhausted) |

| Loan Amount | Tier-1: PKR 1-5 Million Tier-2: PKR 6-30 Million |

| Interest Rate | 0% (Interest-Free) |

| Application Method | Online via akf.punjab.gov.pk |

| Eligibility | Punjab residents, aged 25-55, tax filers, with a registered business |

What is the Asan Karobar Finance Scheme Phase 2?

The Asan Karobar Finance Scheme Phase 2 is a government-backed loan program intended to support small and medium-sized trades (SMEs) in Punjab. With a total distribution of PKR 100 billion, the arrangement aims to:

✔ Provide interest-free loans (up to PKR 30 million)

✔ Encourage new startups and existing businesses

✔ Reduce unemployment by creating job opportunities

✔ Boost Punjab’s economy through monetary inclusion

This is Phase 2 of the arrangement, meaning it has already helped thousands in its first phase. Now, more executives can advantage from this inventiveness.

More Read:AZAG Scheme Reapplication Process 2025

Key Features of Asan Karobar Finance Program Phase 2

Interest-Free Loans – No markup or hidden charges.

Easy Application Process – No need for NOC, license, or building approval.

Flexible Repayment – Up to 5 years to return the loan.

Two Loan Tiers – Choose between PKR 1-5 million (Tier-1) or PKR 6-30 million (Tier-2).

Support for All Sectors – Agriculture, retail, manufacturing, and facilities included.

Loan Details – Tier 1 vs. Tier 2

| Feature | Tier-1 (PKR 1-5 Million) | Tier-2 (PKR 6-30 Million) |

| Security | Personal Guarantee | Secured (Collateral Required) |

| Tenure | Up to 5 Years | Up to 5 Years |

| Interest Rate | 0% | 0% |

| Processing Fee | PKR 5,000 | PKR 10,000 |

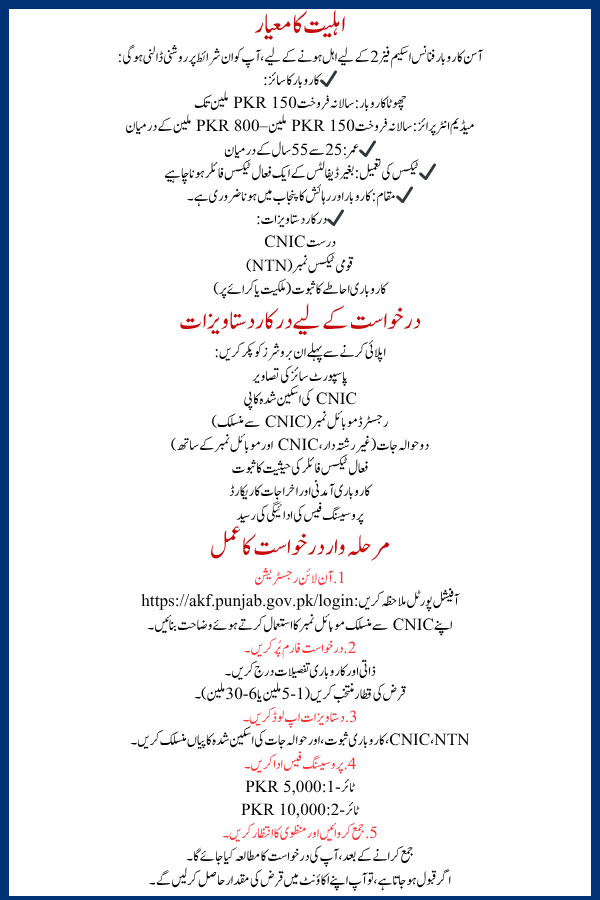

Eligibility Criteria

To qualify for the Asan Karobar Finance Program Phase 2, you requirement light these conditions:

✔ Business Size:

- Small Enterprise: Annual sales up to PKR 150 million

- Medium Enterprise: Annual sales between PKR 150 million – PKR 800 million

✔ Age: Between 25 to 55 years

✔ Tax Compliance: Must be an active tax filer with no defaults

✔ Location: Business & residence must be in Punjab

✔ Documents Required:

- Valid CNIC

- National Tax Number (NTN)

- Proof of business premises (owned or rented)

Required Documents for Application

Before applying, pucker these brochures:

Passport-size photographs

Scanned copy of CNIC

Registered mobile number (linked to CNIC)

Two references (non-relatives, with CNIC & mobile numbers)

Proof of active tax filer status

Business income & expense record

Processing fee payment receipt

More Read:Apni Chhat Apna Ghar Program New Registration 2025

Step-by-Step Application Process

1. Online Registration

Visit the official portal: https://akf.punjab.gov.pk/login

Create an explanation using your CNIC-linked mobile number.

2. Fill Out the Application Form

Enter personal & business particulars.

Select loan row (1-5 million or 6-30 million).

3. Upload Documents

Attach scanned copies of CNIC, NTN, business proof, and references.

4. Pay Processing Fee

Tier-1: PKR 5,000

Tier-2: PKR 10,000

5. Submit & Wait for Approval

After submission, your request will be studied.

If accepted, you’ll obtain the loan quantity in your account.

Loan Repayment Terms

- First 50% Usage:

- Must be used within 6 months.

- Minimum 5% monthly repayment obligatory.

- Second 50% Usage:

- Regular expenditures start after FBR registration.

- Grace Period:

- No payments for the first 3 months after getting the loan.

More Read:BISP Re-Survey Deadline Announced 2025

FAQs – Asan Karobar Finance Scheme Phase 2

Who is eligible for this scheme?

Punjab residents aged 25-55 with a listed business & tax filer status.

How to apply?

Online via akf.punjab.gov.pk.

Can people from other provinces apply?

No, only Punjab-based dealings qualify.

Is collateral required?

Only for Tier-2 loans (PKR 6-30 million). Tier-1 requires a individual assurance.

What’s the maximum loan amount?

Up to PKR 30 million (3 crore).

Final Thoughts

The Asan Karobar Finance Program Phase 2 is a game-changer for minor and average trades in Punjab. With zero interest, flexible repayment, and easy processing, it’s an excellent opportunity to grow your business.

If you meet the worthiness criteria, apply now and take plus of this enterprise previously funds run out!

Official Website: https://akf.punjab.gov.pk